How To Prepare For Economic Recessions?

Economic recessions loom like storm clouds on the horizon, casting shadows of uncertainty over our financial lives. How secure is your job? Will your savings weather the downturn? These questions gnaw at us as we watch markets fluctuate and hear whispers of layoffs.

The harsh reality? Recessions can obliterate jobs, slash incomes, and drain hard-earned savings faster than we imagine. But here's the silver lining - you don't have to be a helpless victim of economic turmoil.

What if you could shield yourself from the worst impacts of a recession? What if you could emerge from the economic storm intact and intact and stronger?

In this blog post, we'll explore practical, actionable steps to fortify your finances against the impending economic headwinds. Ready to recession-proof your future? Let's get started!

How To Prepare For Economic Recessions?

Ready to recession-proof your finances? Let's roll up our sleeves and explore battle-tested strategies that will help you weather any economic storm.

These aren't just good tips; they're practical tools you can use today to build your financial fortress. We're covering all bases, from bulking up your savings to trimming the fat from your budget.

Build An Emergency Fund

Imagine you lose your job tomorrow. How long could you keep the lights on? If that thought makes you break into a cold sweat, it's time to build your emergency fund. Aim for 3-6 months of living expenses in a high-yield savings account.

But how do you get there? Start small. Set up automatic transfers to siphon off a portion of each paycheck. Cut back on non-essentials and funnel that cash into savings. Sell stuff you don't need. Remember, every dollar counts.

Your emergency fund isn't just a safety net; it's peace of mind. It's the difference between a layoff being a speed bump or a cliff. So start building your financial cushion today. Future you will be grateful.

Diversify Your Income Streams

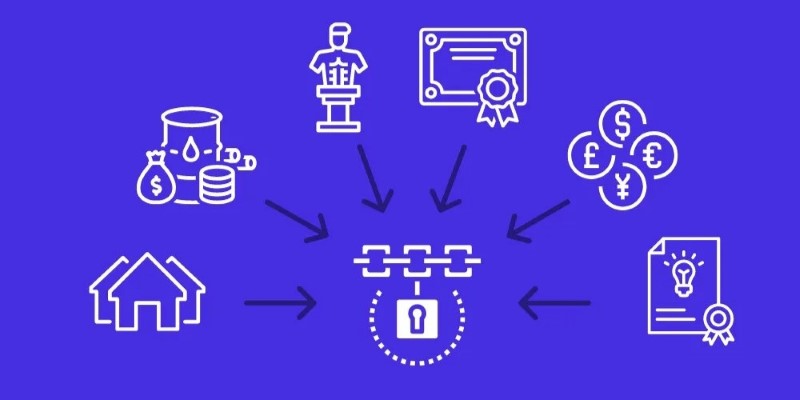

Are you relying on a single paycheck? That's like putting all your eggs in one wobbly basket. It's time to spread your bets. Think side hustles, freelance gigs, or passive income sources. Maybe it's weekend tutoring, selling handmade goods online, or renting out that spare room.

What is the beauty of multiple income streams? If one dries up, you're not left high and dry. It's a chance to flex different skills and explore new passions. Who knows? Your side gig might even blossom into a recession-proof business.

Start small. What skills can you monetize? What assets can generate income? Remember, it's not about working yourself to the bone. It's about creating a financial safety net that catches you when the economy stumbles.

Pay Down Debt

Debt is a ball and chain during good times. In a recession? It's a lead weight dragging you under. High-interest debt, like credit card balances, can spiral out of control when times get tough. So, let's tackle it head-on.

Start by listing all your debts. Target the highest interest rates first, which are usually credit cards. Consider the debt avalanche method: Pay the minimum on all debts but throw extra cash at the highest-interest debt. As each debt falls, redirect that payment to the next highest.

Do you need help to make a dent? Look into balance transfer cards or debt consolidation loans. They could lower your interest rate, helping you pay off debt faster. Remember, less debt means more financial flexibility when the economy takes a nosedive.

Cut Unnecessary Expenses

It's time for some financial spring cleaning. Pull up your bank statements and scrutinize every expense. Has that forgotten subscription been canceled? Cancel it. The overpriced cable package? Negotiate or cut the cord. Are you dining out four times a week? Dust off the cookbook.

But don't just slash unthinkingly. Categorize your expenses: needs, wants, and luxuries. Protect the needs, trim the wants, and seriously question the luxuries. Can you find cheaper alternatives? Can you DIY instead of buying?

Remember, this isn't about living like a hermit. It's about being intentional with your spending. Every dollar you save is a dollar that can cushion you in tough times. Learning to live leaner now means you'll be better prepared when a recession hits.

Invest Wisely

Investing during stable times is like planting seeds for your financial future. However, not all investments are created equal when recession winds blow. Focus on building a diversified portfolio that can weather economic storms.

Consider recession-resistant sectors like healthcare, utilities, and consumer staples. People need medicine, electricity, and food regardless of the economy. Look into dividend-paying stocks for a steady income stream. Please don't shy away from bonds; they're less flashy but more stable when markets get rocky.

Don't try to time the market. Instead, use dollar-cost averaging. Invest a fixed amount regularly, regardless of market conditions. This way, you buy more shares when prices are low and fewer when they're high. It's not about getting rich quickly; it's about building wealth that lasts through booms and busts.

Signs Of An Impending Recession

Think of the economy as a patient. Just like a doctor looks for symptoms, economists watch for telltale signs of an economic downturn. Pay attention to these red flags:

Watch the stock market. Wild swings and prolonged dips often signal trouble brewing. Also, keep an eye on the unemployment rate. If it starts climbing, that's a warning bell. Is GDP growth slowing down or, worse, shrinking? That's another key indicator.

But don't stop there. Listen for buzz about companies scaling back or freezing hiring. Notice if the Fed starts slashing interest rates aggressively. Pay attention to the yield curve; if short-term bonds start yielding more than long-term ones, that's often a recession-harbinger.

Remember, no single sign guarantees a recession. But when several indicators flash red, it's time to batten down the financial hatches.

Secure Your Financial Future Today!

Don't wait for storm clouds to gather. The time to fortify your finances is now. Remember, those who thrive during recessions aren't lucky; they're prepared.

Start building your emergency fund today. Tackle that high-interest debt head-on. Explore new income streams. Every step moves you closer to financial resilience, no matter how small.

You could be stressing about economic uncertainty a year from now, sleeping soundly, knowing you're prepared. The choice is yours.

Don't let fear paralyze you. Take action now. Your future self will thank you for the financial fortress you're building. Ready to recession-proof your life? The time is now. Let's get started.