RMDs Demystified: What You Need To Understand

Is retirement on the horizon? You might be scratching your head about Required Minimum Distributions (RMDs) and their impact on your nest egg. You're not the only one puzzling over this.

RMDs are a crucial piece of your retirement puzzle that you can't shove under the rug. Mishandle them, and you could be staring down some nasty tax penalties. But don't sweat it; getting a grip on RMDs isn't as tough as you might think.

Knowing when to take your withdrawals and how much to take out can save you from a world of financial hurt. It's all about playing your cards right for a comfortable future. Who doesn't want to stretch their savings as far as possible?

In this blog post, we'll discuss the layers, explain how these distributions work, and explore some savvy moves to make the most of your hard-earned retirement stash. Your future self will thank you for taking the time to understand this stuff now!

What Are Required Minimum Distributions (RMDs)?

Why do you seem so interested in your retirement savings? Enter Required Minimum Distributions or RMDs for short. The government says, "Time to start using that tax-deferred money!"

In a nutshell, RMDs are the smallest amount you've got to pull from your retirement accounts each year once you hit 72. They apply to your 401(k)s, traditional IRAs, and other qualified plans you have been squirreling money into.

Think of it as the IRS tapping its foot, waiting to collect those taxes you've been putting off. It's their way of ensuring you don't just sit on that nest egg forever.

When Do RMDs Start?

Gone are the days when 70 1⁄2 was the magic number for RMDs. Thanks to the SECURE Act, you can sit pretty until you hit 72 before dipping into those retirement funds. It's like getting a bonus year and a chance to let your nest egg grow, not too shabby.

But stay cozy. The powers that be are always tinkering with these rules. Rumor has it they might even push it to 75 down the road. So keep your ear to the ground and your eyes peeled. In this retirement rodeo, staying in the loop is half the battle.

How Are RMDs Calculated?

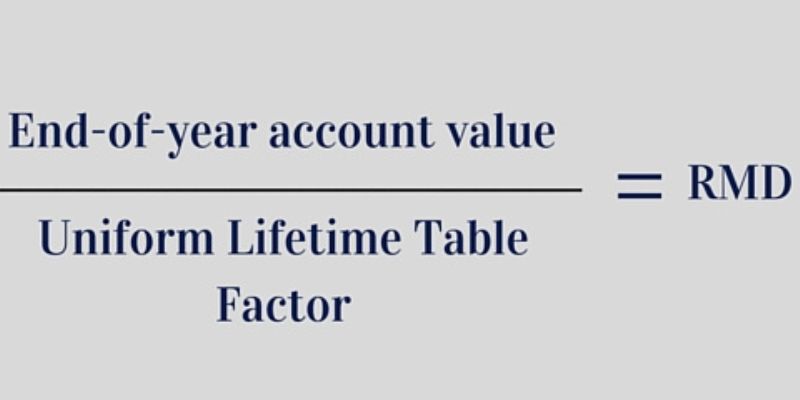

How does Uncle Sam figure out your RMD? It's not rocket science, but it's also not back-of-the-napkin math. You peek at your account balance from December 31st of last year, then divide it by a number from their life expectancy tables. They're betting on how long you'll stick around charming, right?

Let's say you're 75 with a cool $100,000 in your IRA. The IRS life expectancy factor for a 75-year-old is about 22.9. So, $100,000 divided by 22.9 gives you an RMD of roughly $4,367. Simple enough, but remember this changes yearly as your balance and age shift.

What Happens If You Don't Take Your RMD?

Need to take your RMD? Brace yourself because you're not messing around. If you miss that withdrawal, you'll be hit with a gut punch of a penalty. We're talking 50% of what you should've taken out. It's like the IRS is standing there with a giant paddle, ready to whack your wallet.

Let's say you were supposed to withdraw $5,000, but it slipped your mind. That's a $2,500 penalty headed your way. And that's on top of the regular taxes you owe. So, do yourself a favor. Mark those RMD deadlines on your calendar in big, bold letters. Your bank account will thank you.

Tax Implications Of RMDs

Here's the deal with RMDs and taxes: they're like peanut butter and jelly, always stuck together. When you pull out those RMDs, your hand is right there, palm out. These withdrawals get taxed as ordinary income. So, if you're not careful, they could bump you into a higher tax bracket faster than you can say "retirement."

But don't panic. There are ways to soften the blow. Some folks play it smart by converting chunks of their traditional IRA to a Roth before RMDs kick in. It's like paying the piper now to dodge him later. Remember, a little tax planning goes a long way. Your future self might buy you a drink to think ahead.

Can You Delay Or Avoid RMDs?

So, you're not keen on dipping into your retirement cookie jar? Well, you've got a few tricks up your sleeve. Are you still punching the clock past 72? If your 401(k) is with your current employer, you might be able to push those RMDs down the road. Just don't get too cozy; it's only a reprieve.

Want to stick it to RMDs? The Roth IRA's your best buddy. Convert your traditional IRA to a Roth, and poof, no more RMDs. Sure, you'll pay taxes on the conversion, but it's smooth sailing after that. Remember, dodging RMDs is like playing financial chess. Plan your moves carefully, and you might score a checkmate.

Take Control Of Your Retirement: Master RMDs Today!

Refrain from letting RMDs catch you off guard. It's time to take control of your retirement and ride off into the sunset on your terms. Arm yourself with knowledge, build a solid plan, be bold, and use expert help. Your golden years are too precious to leave to chance.

Remember, understanding RMDs isn't just about avoiding penalties; it's about maximizing the potential of your hard-earned savings. So, what are you waiting for? Take charge, and turn those RMDs from a headache into a strategy. Your future self will thank you for it!