What Is Quantitative Easing, And How Does It Affect The Market?

Quantitative Easing (Q.E.) is a term that often surfaces in discussions about economic policies, especially during periods of financial downturn. It is a monetary policy tool central banks use to inject liquidity into the economy and encourage lending and investment when conventional interest rate adjustments are insufficient. Understanding Q.E. and its implications on the financial markets is crucial for grasping how governments attempt to stimulate economies during challenging times.

Understanding The Basics Of Quantitative Easing (Q.E.)

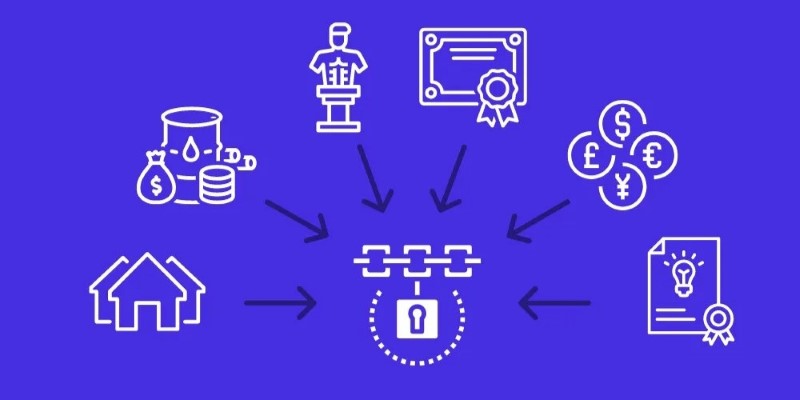

Quantitative Easing (Q.E.) is a nontraditional monetary policy employed by central banks, such as the U.S. Federal Reserve, to stimulate the economy when standard monetary policies are no longer effective. Essentially, Q.E. involves the central bank purchasing financial assets, primarily government bonds and mortgage-backed securities, to increase the money supply and lower interest rates. By doing so, the central bank aims to make borrowing cheaper, encourage spending, and promote investment.

Q.E. became prominent during the Global Financial Crisis 2008 when interest rates were pushed close to zero, and the economy required additional stimulus. Central banks couldn't lower rates further, so they resorted to Q.E. to increase liquidity in the market and encourage lending.

How Quantitative Easing Works In The Economy?

When a central bank implements Q.E., it buys government bonds and other financial assets from commercial banks and other financial institutions. This process injects money into the banking system, increasing bank reserves and enabling them to lend more freely. By creating new bank reserves, Q.E. lowers the interest rates on bonds and other forms of debt, making borrowing cheaper.

The immediate effect of Q.E. is a reduction in long-term interest rates, which, in turn, makes mortgages, loans, and other credit forms more accessible and affordable. This stimulates spending by businesses and consumers, leading to increased investment and consumption, which ultimately supports economic growth. In the case of the U.S. Federal Reserve, this policy played a significant role in mitigating the economic impacts of the 2008 financial crisis and the COVID-19 pandemic, helping to stabilize financial markets and spur recovery.

However, Q.E. can also have the unintended consequence of increasing inflation if implemented excessively. The increase in money supply can devalue the currency, causing prices to rise. The time lag between Q.E. implementation and the appearance of inflationary pressures can be 12 to 18 months, which makes it challenging to measure the full effects immediately.

The Impact Of Quantitative Easing On Financial Markets

To fully understand Quantitative Easing's effects, it is essential to examine how it influences different financial markets, including stocks, bonds, and currency values. Let's explore these impacts further.

Influence On Stock Markets

Quantitative Easing often leads to a rise in stock prices. As interest rates fall, the yields on traditional safe investments like government bonds become less attractive, driving investors towards higher-yielding assets such as stocks. This influx of capital tends to push up stock market valuations, creating a wealth effect that encourages further spending and investment. During the period of Q.E. implemented by the Federal Reserve, the stock market experienced substantial gains as investors shifted funds into equities to seek better returns.

Bond Markets And Interest Rates

Q.E. directly impacts bond markets by increasing demand for government bonds and other fixed-income securities, thereby increasing prices. When bond prices rise, yields fall, lowering long-term interest rates. This makes borrowing more affordable for businesses and consumers, stimulating economic activity. The U.S. Federal Reserve's Q.E. programs have significantly reduced lower interest rates, contributing to more favourable lending conditions.

Currency Devaluation

Another side effect of Q.E. is currency devaluation. By increasing the supply of money, the value of the domestic currency tends to fall relative to other currencies. While this can make exports more competitive by making them cheaper for foreign buyers, it also makes imports more expensive, leading to inflation. Countries that have implemented Q.E., such as Japan, the U.K., and the Eurozone, have witnessed periods of currency devaluation during their Q.E. programs.

Pros And Cons Of Quantitative Easing For Investors

While Q.E. offers several benefits that can create favourable conditions for investors, it also presents notable risks and challenges. Examining both sides is essential to understanding its overall impact.

Pros

One of the main advantages of Q.E. is that it often boosts stock prices, as the influx of capital into the market drives up equity valuations, resulting in potential gains for investors' portfolios. Additionally, Q.E. makes borrowing more affordable by lowering interest rates, which benefits individuals and businesses looking to finance projects or investments. This increased access to cheaper credit can lead to more investment opportunities and expansion.

Moreover, Q.E. enhances liquidity within the financial system, making it easier for investors to buy and sell assets, thereby supporting smoother market operations. Lastly, by encouraging borrowing and spending, Q.E. can stimulate economic growth, which, in turn, boosts corporate profits and dividends, offering further benefits to investors.

Cons

Quantitative Easing (Q.E.) carries several drawbacks for the economy and investors. One of the primary risks is inflation, as the increased money supply can lead to rising prices over time. This erosion of purchasing power is particularly concerning for investments in fixed-income securities, where returns may not keep pace with inflation. Another issue is the creation of asset bubbles. As Q.E. encourages investment in riskier assets, bubbles will likely form, leading to significant market corrections and potential losses when these bubbles eventually burst.

Despite the additional liquidity injected into the banking system, lending might only sometimes increase, as banks may remain cautious about economic uncertainties, leading to a credit crunch. Lastly, Q.E. often results in currency devaluation, which, while beneficial for exporters, can negatively impact international investors by reducing returns when converting profits back into their stronger home currency.

Conclusion

Quantitative Easing (Q.E.) is a robust monetary policy tool that central banks use to stimulate the economy during financial stress or economic downturns. It lowers interest rates, encourages borrowing and spending, and often boosts asset prices. While Q.E. can positively affect the economy and financial markets, it also carries risks such as inflation, currency devaluation, and the potential creation of asset bubbles. Investors must know these dynamics to make informed decisions when Q.E. is in effect. Understanding Q.E.'s impact on markets helps navigate investment strategies during periods of economic uncertainty and central bank intervention.