Annuities Explained: Benefits You Need To Know

Planning for retirement can feel overwhelming, with so many financial options to consider. Have you ever wondered how annuities might fit into your retirement strategy? If you're nodding your head, you're not the only one.

Annuities often fly under the radar but are powerful in your financial toolkit. They offer something truly valuable: reliable income for your later years. They can be one of the best ways to ensure you never run out of money in retirement.

By choosing the right annuity, you can enjoy peace of mind knowing that your financial future is secure. Whether you're looking for guaranteed income or tax advantages, annuities offer flexibility to suit your unique retirement needs. So, let's dive in and demystify annuities.

In this blog post, we'll explain their benefits and how they can fit into your retirement plan. Ready to take control of your financial future? Let's get started!

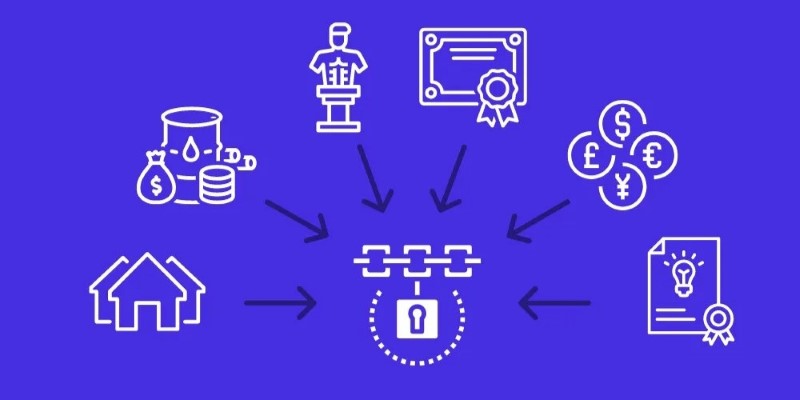

What Is An Annuity?

Think of an annuity as a financial agreement between you and an insurance company. You invest money now, and they promise to pay you later, often for the rest of your life. It's like creating your pension.

There are different flavors of annuities. Fixed annuities offer steady, predictable payments. Variable annuities can grow with the market but come with more risk. Indexed annuities try to strike a balance between the two.

The beauty of annuities lies in their ability to provide a steady income stream during retirement. They can help ensure you don't outlive your savings, giving you one less thing to worry about in your golden years.

Guaranteed Income For Life

Imagine never having to worry about running out of money in retirement. That's the peace of mind annuities can offer. They're like a financial safety net, catching you if your other savings fall short.

Here's the deal: you pay into an annuity, and it pays you back for as long as you live. It's that simple. No more fretting about market crashes or outliving your nest egg.

This steady income can cover your basic needs, letting you use other investments for fun. It's about sleeping easier at night, knowing you've got a reliable financial foundation. In a world of uncertainty, annuities offer a rare guaranteed income that lasts as long as you do.

Tax-Deferred Growth

Let's talk about a sweet perk of annuities tax-deferred growth. It's like having a secret garden where your money can flourish without the taxman taking a bite out of it yearly.

Here's how it works: The money you put into an annuity grows without tax. Your earnings can earn more profits, and those earnings earn even more. It's a snowball effect but with cash instead of snow.

You only pay taxes when you take the money out, usually in retirement. You might be in a lower tax bracket, saving you even more. This tax-deferred growth can help your nest egg grow bigger and faster, giving you more to enjoy in your golden years.

Flexibility In Payment Options

Annuities aren't one-size-fits-all; they're more like a buffet of financial options. You get to pick what works best for you. Need a big chunk of cash? Some annuities let you take a lump sum payment. Would you prefer a steady paycheck? Set up monthly income streams.

Want the freedom to withdraw when you need it? Flexible schedules are on the menu, too. You may want payments for a set number of years, or you're after lifetime income.

Some folks even choose annuities that continue paying their spouse after they're gone. The point is that annuities can be adapted to fit your life. It's your retirement; shouldn't your money work how you want it to?

Protection Against Market Volatility

Ever feel like the stock market is a roller coaster you can't get off? Fixed annuities offer a smooth ride instead. While the market zigs and zags, fixed annuities stand firm. They're like a financial bomb shelter, protecting your nest egg from economic storms. When stocks plummet, your annuity keeps chugging along, paying out just as promised.

This stability can be a godsend, especially as you near retirement. No more nail-biting over market reports or losing sleep over your savings. Fixed annuities let you plan confidently, knowing exactly what you'll get, rain or shine. In a world of financial uncertainty, they're a slice of predictability you can count on.

Secure Your Future: Discover The Power Of Annuities Today!

Ready to take charge of your retirement? Annuities could be the missing piece in your financial puzzle. They offer guaranteed income, tax benefits, and peace of mind, a trifecta that's hard to beat.

But remember, every journey to financial security is unique. What works for your neighbor might not be the best fit for you. That's why chatting with a financial advisor who can tailor a plan to your specific needs and dreams is crucial.

Don't leave your golden years to chance. Explore how annuities can help you build a rock-solid retirement. After all, you've worked hard now; let your money work hard for you. Your future self will thank you!